Author: David I. Templeton, CFA, Principal and Portfolio Manager

The talk of a recession has been ongoing for what seems like more than a year. One such headline from mid-year 2022 can be read here and predicted the U.S. economy would be in a recession by the third quarter of 2022. One factor driving the recession talk is the Federal Reserve's higher interest rate push in an effort to lower the rate of inflation. Historically, when the Fed increases short term interest rates, their tighter policy has gone too far and the economy has fallen into recession. In addition to higher interest rates, the Fed is draining liquidity from the economy by reducing the size of its balance sheet, which had ballooned to $9 trillion as a result of monetary support during the pandemic that began in 2020.

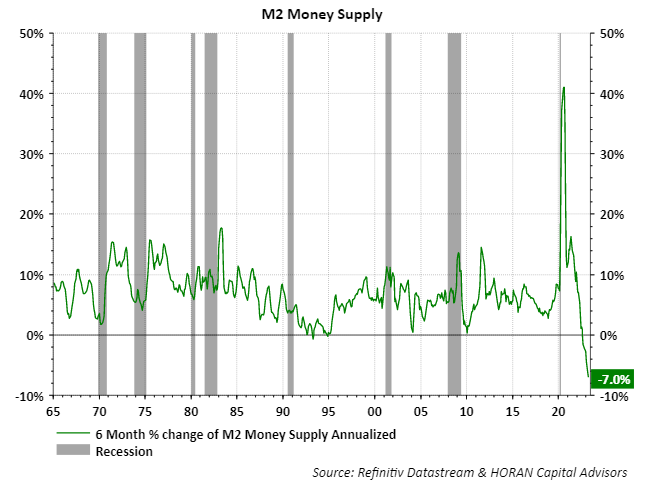

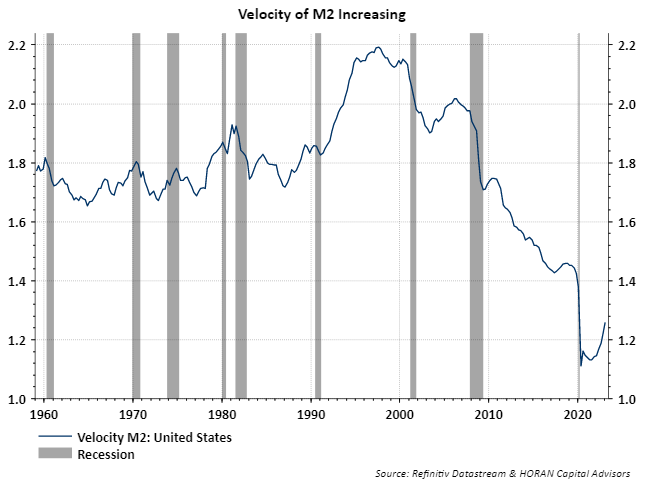

In several prior blog posts, one from 2009, I discussed the Quantity Theory of Money, and the relationship between money supply, velocity of the money supply, price level and quantity of output. More detail can be found in the earlier article, but note, velocity equals nominal GDP divided by the money supply, M2 for this article. Since the late 1990's velocity of the money supply has been trending lower and seemed to collapse after the pandemic. One reason for the collapse was the desire by consumers to hold onto money via increased savings. Additionally with the economy shuttered, one could not spend money. With the stimulus dollars held in savings, consumer eventually began to get comfortable with spending and have been reducing their savings and desire to hold dollars. Spending the excess savings is one factor that has led to the inflation fight pursued by the Fed. With the Fed draining liquidity from the economy, the money supply is contracting sharply. M2 is defined as M1, which is cash and checking account deposits, plus savings accounts, individual money market accounts and CD's under $100,000.

An increasing velocity of the money supply is generally associated with a strengthening economy. In other words a recession does not seem imminent if using the Quantity Theory of Money as a guide. Consumers are spending dollars as they are less concerned about their own economic situation. Of course, increased spending by consumers can place upward pressure on the price of goods and services, which the Fed is mindful of. By continuing to reduce the money supply though, this can act as a restraint on inflation too. M2 remains far higher than its pre-pandemic level so the Fed has more work to do in pulling excess liquidity from the economy.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.