Author: David I. Templeton, CFA, Principal and Portfolio Manager

On Friday the markets digested comments from Federal Reserve chairman, Jerome Powell that came from the Jackson Hole economic symposium. Based on his comments, the Fed Chair left little doubt the push higher in short term interest rates will continue. In other words a so called pivot or pause in rate hikes is not on the table at this point in time. Of particular note in the comments was the following excerpt in his speech:

"Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses (emphasis added.) These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

It is clear the Fed views inflation as a continuing issue and Friday's market reaction was in response to an expectation of further interest rate increases ahead. The Dow Jones Industrial Average declined 1,008 points or 3.03% and the broader S&P 500 Index fell 141 points or 3.37%. This price action interrupted the bullish trend of the market in place since the June 16 low. As the top panel on the below chart shows, the S&P 500 Index fell out of the uptrend channel in place since mid June and this puts the 50 day moving average, around 3,996, as the next level of technical support for the market. A favorable trend remains in the Money Flow Index but needs to hold support and the Stochastic Oscillator, in the second to last pane, is indicating the market may be oversold from this decline and setting up for a bounce.

It is difficult to predict short term market movements, but AAII's individual investor bullish sentiment of 27.7% remains more than one standard deviation below its historical average of 38%. Sentiment measures are contrarian indicators and the low AAII bullishness reading would be viewed as bullish for stocks looking six months into the future. The CNN Fear & Greed Index fell into the Fear range at 44 and down from 57 a few weeks ago, a reading in the Greed range. Extreme fear levels for this index have not been reached nor on some other sentiment measures as well. At the time of wring this article, S&P 500 Index futures were down about 1% Monday morning.

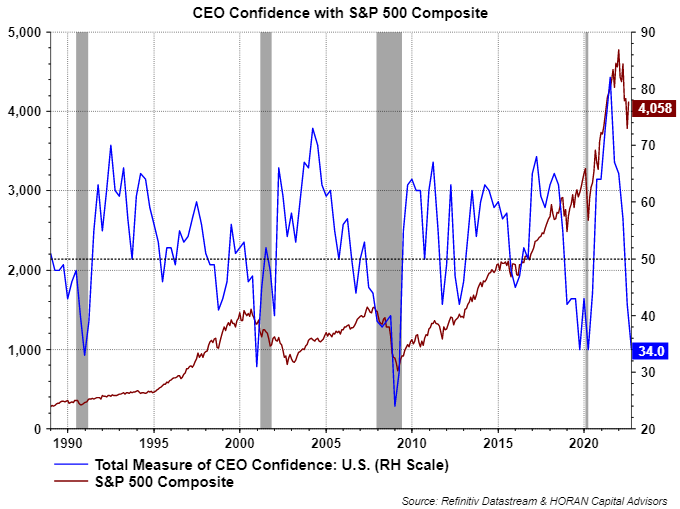

The last sentiment reading to highlight is the Measure of CEO Confidence reported by The Conference Board (TCB.) The CEO Confidence level was reported at 34 for the third quarter and TCB notes, "The Measure has fallen deeper into negative territory, to lows not seen since the start of the COVID-19 pandemic in 2020, but consistent with prior contractionary periods. (A reading below 50 points reflects more negative than positive responses.)" The survey noted that 81% of the CEO's were preparing for a short but shallow recession. Interestingly though, 76% of the CEO's noted business has risen or held steady in the most recent three month period. It is sometimes stated that the stock market and the economy are not the same and react differently. As the below chart shows, weak CEO Confidence has some contrarian aspects to it, that is, low confidence tends occurs near equity market lows.

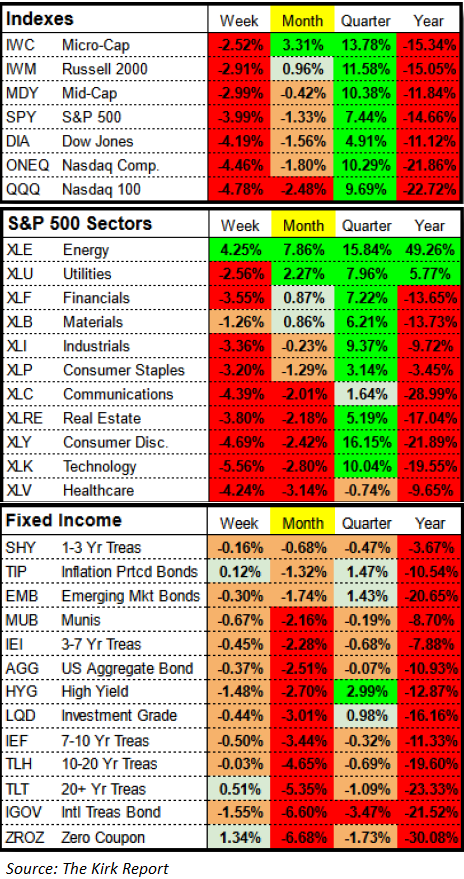

For investors, this year's investment market has been a challenging one. The performance of a diversified portfolio has been one of the worst in the last 50-years, that is, not much has generated a positive return except for some commodities, especially energy, and utilities. Reviewing the year to date performance column in the below table confirms the difficult environment faced by investors.

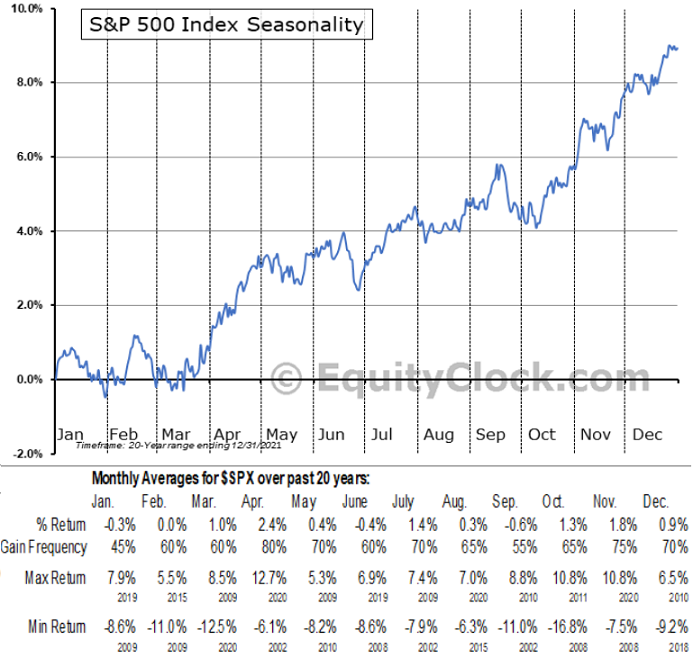

In conclusion, the market calendar is entering a seasonally volatile period with the month of September just around the corner. Additionally, this is a midterm election year and the equity market tends to be more volatile until after the midterm election itself. After the election uncertainty is resolved, strong equity market returns have followed mid term elections as we noted in our Summer 2022 Investor Letter.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.