Author: David I. Templeton, CFA, Principal and Portfolio Manager

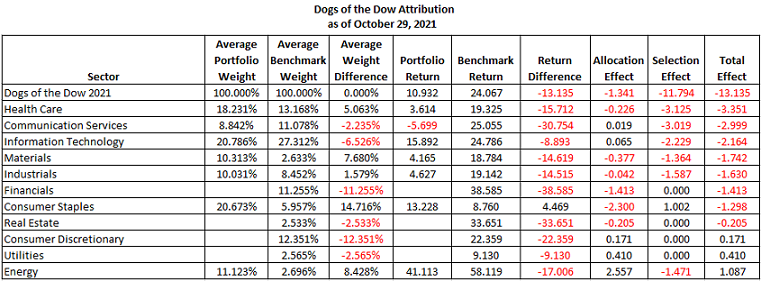

The Dogs of the Dow investment strategy jumped out to a fast start during the first quarter, outperforming both the S&P 500 Index and the Dow Jones Industrial Average Index by 300 to 400 basis points. During the second and third quarter though, the Dow Dog strategy actually generated a negative return while the Dow Jones Index and the S&P 500 Index were mostly up double digits.

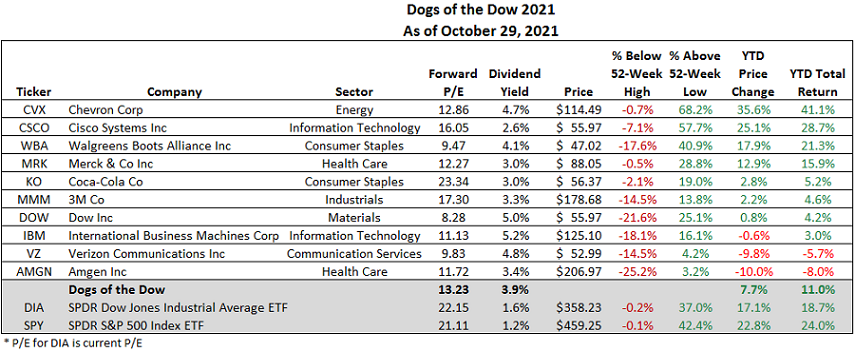

Several factors account for the return difference early this year versus the second and third quarter return. Early this year the value investment style was outperforming growth. In the second and third quarters though growth once again dominated investment returns. If using the S&P 500 as a comparison, the Dow Dog strategy outperformed in only one sector and that was the consumer staples sector. The stock that contributed to this outperformance was Walgreens Boots Alliance (WBA). The sector that contributed the most to the Dow Dog's underperformance was in Health Care. Not only did the two Health Care stocks underperform, the Health Care weighting for the Dow Dog portfolio is 18.2% versus the S&P 500 Index weighting of 13.2%. The second most negative sector contributor was Communication Services. Verizon Communications (VZ) is the only holding in the Dow Dog portfolios and the table above shows it is one of the two stocks with a negative total return.

The Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. The popularity of the strategy is its singular focus on dividend yield. This income/yield focus tends to lead to the Dow Dog strategy being a more value oriented one. With the recent performance turn towards the growth style and away from value, the Dow Dog strategy likely faces a headwind for the balance of the year. If this is the case, the 2021 returns will be the third consecutive year the strategy underperforms the broader market.