Author: David I. Templeton, CFA, Principal and Portfolio Manager

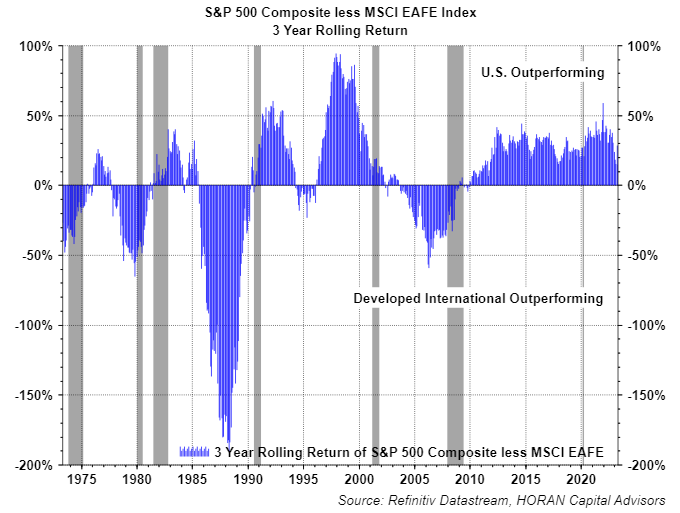

Over the past 15 years international developed market equities as measured by the MSCI EAFE Index have outperformed the S&P 500 Index in only four years and one of those years was 2022. Since 2010 the rolling 3-year return has favored the S&P 500 Index as seen in the below chart. Historically the length of the outperformance of either index has not lasted this long.

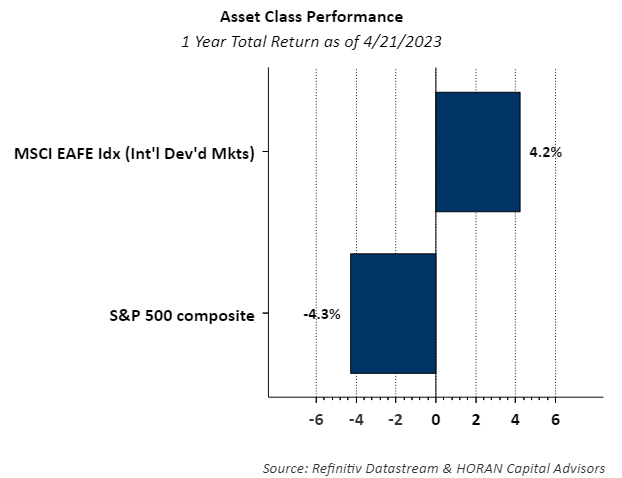

Since the beginning of 2022 though, international developed equities have outperformed the S&P 500 Index and over the last 12-months the MSCI EAFE Index return of 4.2% exceeds the S&P 500 Index return that is down -4.3%.

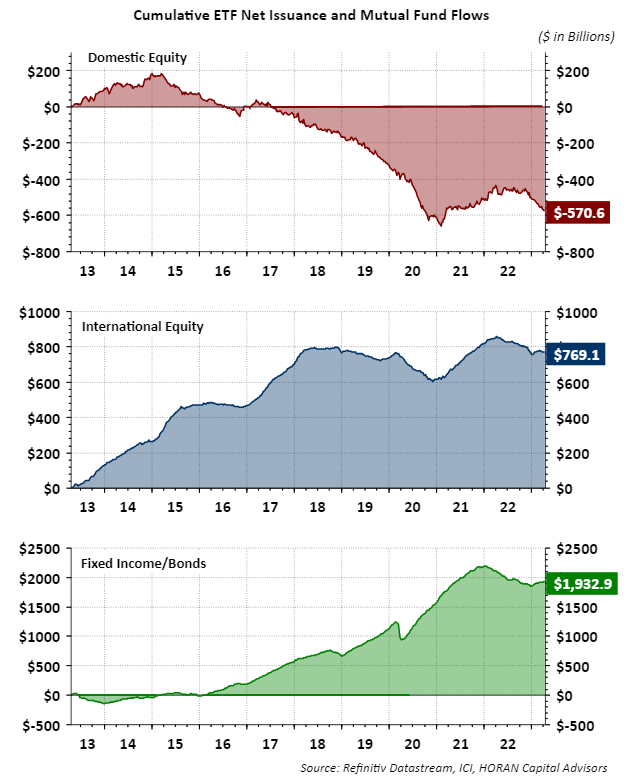

Although U.S stocks have had an extended run outperforming the MSCI EAFE Index, equity fund flows into mutual funds and ETF's have favored international equities. The top two panels in the below chart show the flows into domestic (U.S.) equities and international equities. Fund flows into fixed income investments have had a fairly steady positive bias. Fixed income or bonds tend to serve as a shock absorber when equities decline. This was not the case last year with the Bloomberg U.S. Aggregate Bond Index down -13.01%.

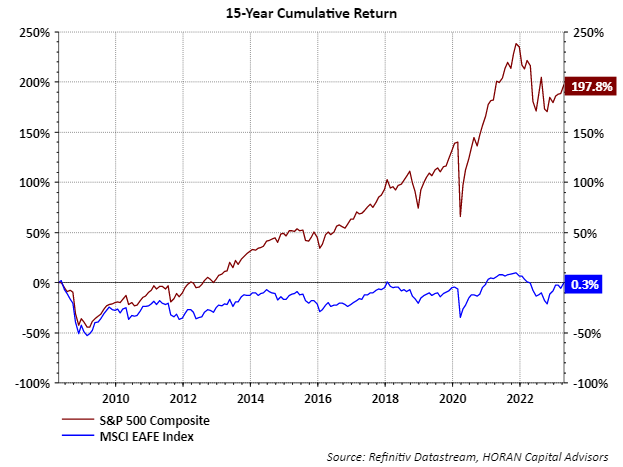

With the recent 18-month period of developed international equities outperforming U.S. large company equities, possibly a longer trend is developing. The magnitude of the U.S. large cap outperformance can be seen in the below chart. Granted, U.S. large cap companies are doing business internationally, but maintaining some direct international exposure seems appropriate at this point in time.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.