Author: David I. Templeton, CFA, Principal and Portfolio Manager

In my post on Sunday I touched on a potential deal with UBS acquiring Credit Suisse. Shortly after posting that earlier blog article, the UBS/Credit Suisse deal was announced. The UBS acquisition is being done at a value a little more than half Credit Suisse's value a few days ago. Credit Suisse's issues go back a few years and the bank's difficulties are not simply a result of the liquidity issues facing other U.S. and global banks.

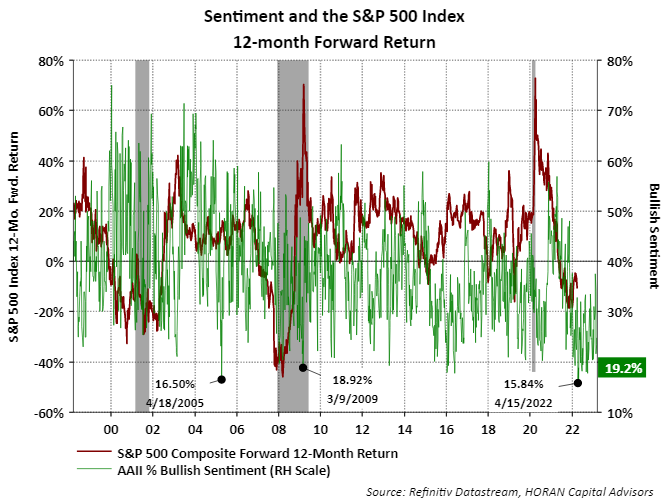

As in prior crisis periods for the banks, like the 2008/2009 financial crisis, some investors used the crisis to structure favorable investment deals. One such investor has been Warren Buffett. As Warren Buffett has said in the past, "Be fearful when others are greedy, and greedy when others are fearful." Some of the recent sentiment data suggests fear has overcome the market and unarguably overcome some of the financial stocks. One fear measure is the American Association of Individual Investors Sentiment Survey. Last week's survey reported investor bullish sentiment fell to 19.2% from the prior week level of 24.8%. As the below chart shows, individual investor bullish sentiment has been at a low level for most of this year. The maroon line on the below chart shows the 12-month forward return for the S&P 500 Composite Index and low bullishness readings are associated with higher 12-month forward returns. Just to highlight though, there are no certainties with this reading and the 12-month forward return from the April 15, 2022 low reading remains in negative territory.

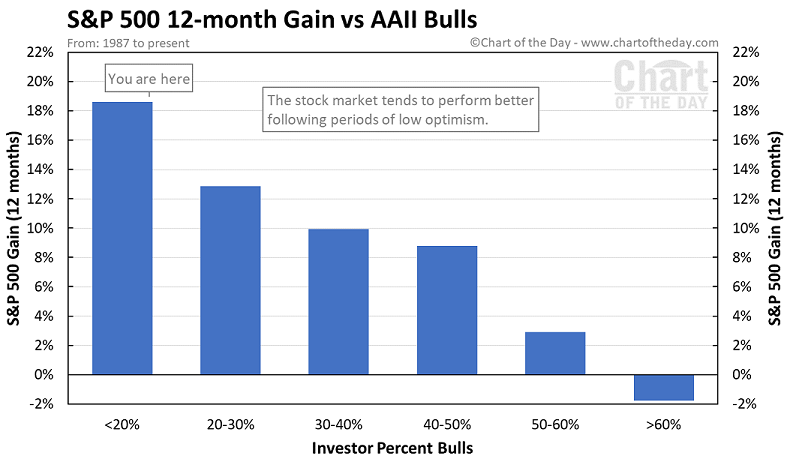

The next chart below represents a different view of the above sentiment data. The chart was prepared by Chart of the Day and the bars in the below chart represent the 12-month average gain for the S&P 500 Index across different bullishness levels. With the current AAII bullishness reading below 20%, the first bar in the below chart represents where the reading falls today.

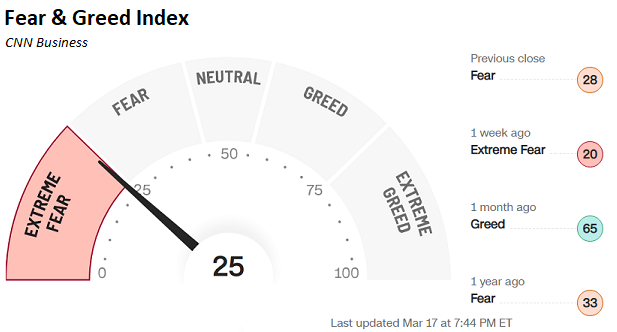

Another fear indicator is CNN Business' Fear & Greed Index. This is an interesting Index as it incorporates seven sentiment indicators into one to arrive at the overall Fear & greed Index measure. Last week the indicator fell back into the extreme fear range, indicating a market that is in a high state of fear.

So back to Warren Buffett's "be greedy when others are fearful" quote, in today's technological age, not much happens in secrecy if it is available on the internet. One author that indicates they mostly short stocks, noted late last week a large number of private jets, greater than twenty, landed in Omaha, Nebraska. The author notes many of the jets came from cities where regional banks have a presence or headquarters.

A large number (>20) of Private Jets landed in Omaha yesterday afternoon

— FuzzyPanda 🇺🇦 (@FuzzyPandaShort) March 17, 2023

Jets flew from HQs of Regional Banks, Ski Resorts & DC

Did Buffett just fly all the regional bank CEOs into Omaha & offer a deal to SAVE the banks?$BRK.B$WAL, $PACW, $FRC, $ZION, $KEY, $FITB, &more

🧵 pic.twitter.com/HNSrn7i8So

Could it be that Warren Buffett is sensing an investment opportunity and ready to become a bit greedier?

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.