Author: David Templeton, CFA, Principal & Portfolio Manager

Earlier this week the equity market reacted negatively to the Biden Administration's tax proposal ($$), specifically an increase in the capital gains tax rate. In the proposal he plans to detail in a speech before a joint session of Congress next week, the capital gain tax rate on households making more than $1 million will increase to as much as 43.4%. This is arrived at by increasing the capital gain tax rate to 39.6%, with the extra 3.8% Medicare tax for incomes above $200,000 for single filers and $250,000 for joint filers. The current top capital gain tax rate is 20%. When news of the tax increase came out on Thursday, the Dow Jones Industrial Average ended up declining over 300 points on the day.

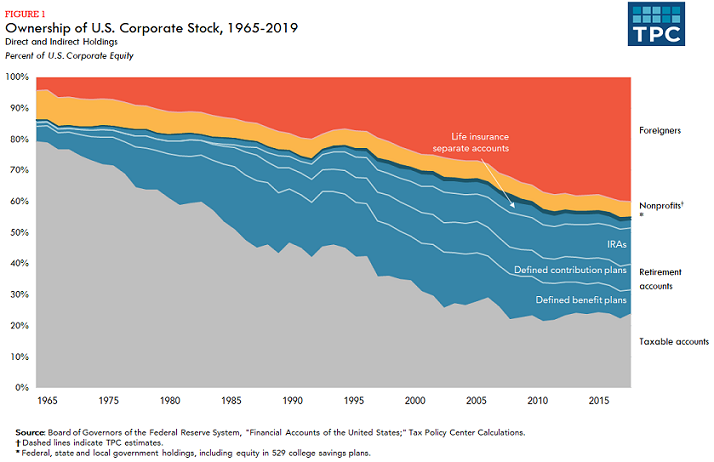

The market's initial negative reaction centered around concerns that increased selling would tax place this year to lock in the lower capital gains tax rate along with potential headwinds due to higher taxes broadly. Certainly this large of an increase in the capital gain tax rate seems unproductive and one would think bipartisan negotiations would result in a smaller increase. However, investors should be mindful of the fact that a smaller percentage of stock holdings are held in taxable accounts. The Tax Policy Center prepared the below chart in a report late last year. The grey chart area represents the percentage of stocks that are held in taxable accounts. In the mid 1960's as much as 80% of stock holdings were in taxable accounts. As of 2019, the weighting has declined to just 25%. The significance is a lower amount of stocks will be subject to the higher capital gain tax rate anyway.

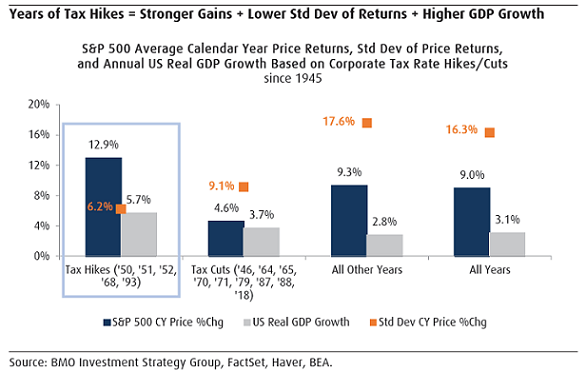

And lastly, with the high likelihood of higher tax rates being in place in 2022 and beyond, investors should note this has not always been a headwind for stocks. The below chart from BMO Investment Strategy Group shows the performance of the S&P 500 Index during periods taxes were either raised or lowered since 1945. In the years of tax increases, the S&P 500 Index generated better returns versus years in which tax cuts were instituted. Additionally, GDP growth was stronger in the years where tax hikes were instituted as well.

Much can be debated on whether tax cuts or tax increases are a good policy decision. In the current environment though, with the economy exiting a recession and a large amount of pent up demand needing to be satisfied, the economy and stock market may be able to shake off this potential tax headwind if the increase is not too onerous.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.