Author: David I. Templeton, CFA, Principal and portfolio Manager

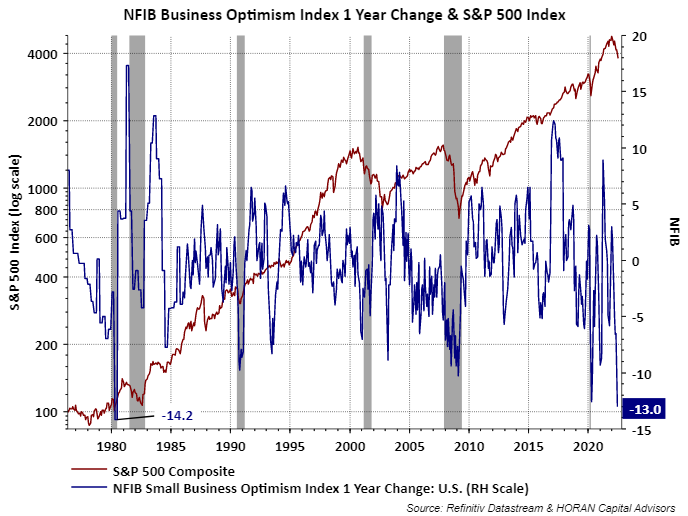

Yesterday's blog post noted the bearish view expressed by institutional and individual investors and now today, small business optimism has fallen a near record thirteen points from a year ago. The June Index level was reported at 89.5 and the NFIB report notes this represents "the sixth consecutive month below the 48-year average of 98."

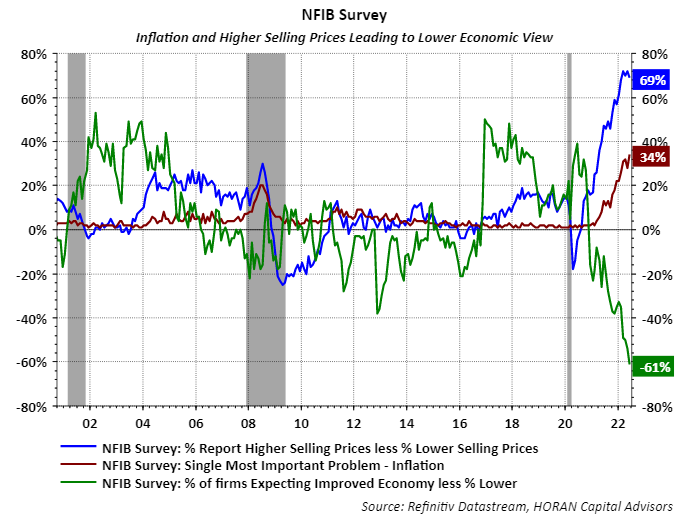

A net negative 61% of small business owners, a seven point decline from last month, are expecting better business conditions over the next six months. This is the lowest reading recorded for this measures since the survey's inception 48-years ago.

Inflation is an issue for business. The report notes,

- "Inflation continues to be a top problem for small businesses with 34% of owners reporting it was their single most important problem in operating their business, an increase of six points from May and the highest level since quarter four in 1980."

- “As inflation continues to dominate business decisions, small business owners’ expectations for better business conditions have reached a new low. On top of the immediate challenges facing small business owners including inflation and worker shortages, the outlook for economic policy is not encouraging either as policy talks have shifted to tax increases and more regulations,” said NFIB Chief Economist Bill Dunkelberg.

The most significant headwind for small business is inflation. Getting inflation under control would have a beneficial follow through for the stock and bond markets, but relief does not appear to be imminent.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.