Author: David I. Templeton, CFA, Principal and Portfolio Manager

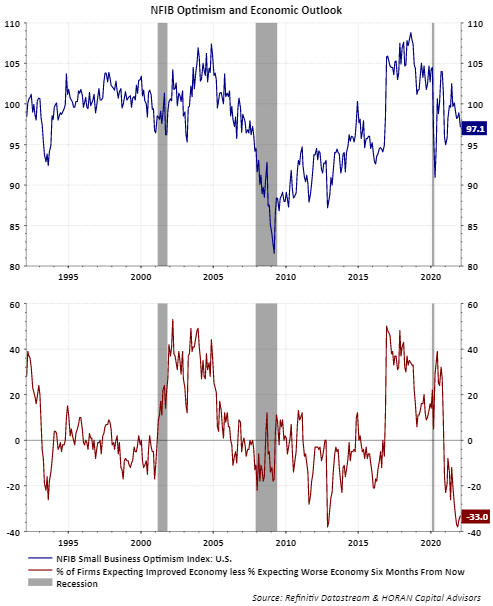

The January NFIB Small Business Optimism Index was reported at 97.1, down 1.8 points. This is the lowest reading for the Index since the February 2021 reading of 95.8. Additionally, small businesses continue to have a dim view on the economy with more small businesses expecting a worsening economy by 33 points versus an improving one.

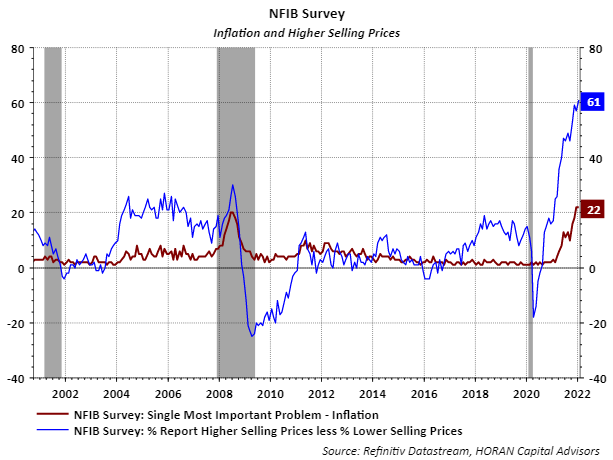

According to the survey, "a net 7% of owners viewed current inventory stocks as “too low” in January, down two points. A net 3% of owners plan inventory investment in the coming months, down five points from December, reflecting the success in inventory building in the fourth quarter." This improving inventory situation may take pressure of inflation. It is too early to tell but this is a positive data point. In the survey though, inflation was cited as an issue. The report notes, " Inflation remains a problem for small businesses as 22% of owners reported that inflation was their single most important business problem, unchanged from December when it reached the highest level since 1981. The net percent of owners raising average selling prices increased four points to a net 61% (seasonally adjusted), the highest reading since the fourth quarter of 1974."

Although the inventory situation seems to by improving and moving in a positive direction, inflation remains an issue in the near term for sure and is an important factor contributing to weaker business optimism.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.