Author: David I. Templeton, CFA, Principal & Portfolio Manager

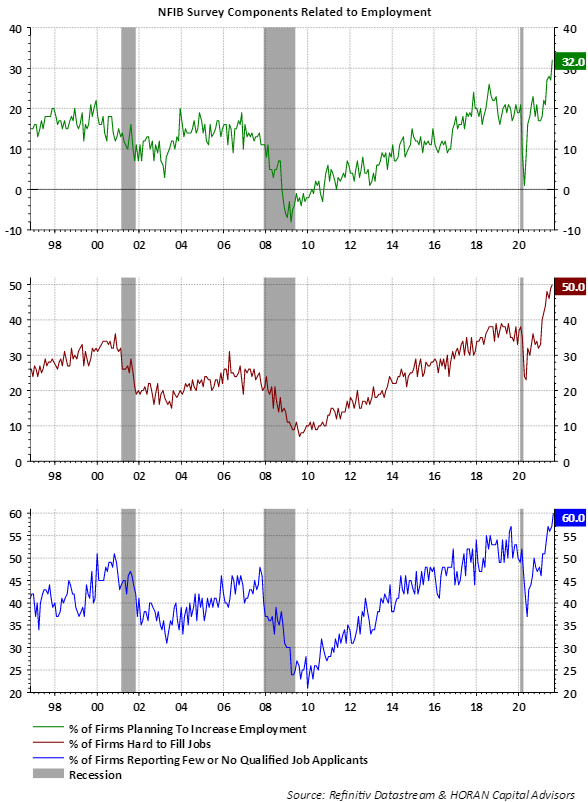

Over the past several months I wrote articles that focus on various employment issues, with the end result noting companies are struggling to hire employees. The inability for companies to hire is occurring at a time when job openings are high and the number of individuals unemployed is high. Last week's NFIB Small Business Optimism Index report noted the issues small businesses are facing with hiring. The bottom panel on the below chart shows a record 60% of those surveyed report few are no qualified job applicants.

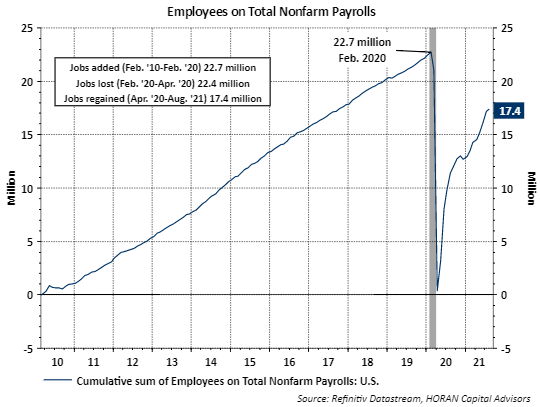

The fact is companies have 10.9 million open positions and there are 8.4 million unemployed individuals. In other words there are more openings than those unemployed as noted in the first article link above. Certainly some unemployed individuals may not have the skill set required of some job openings, Yet, the number of individuals on payrolls remains 5.3 million below the pre-pandemic high.

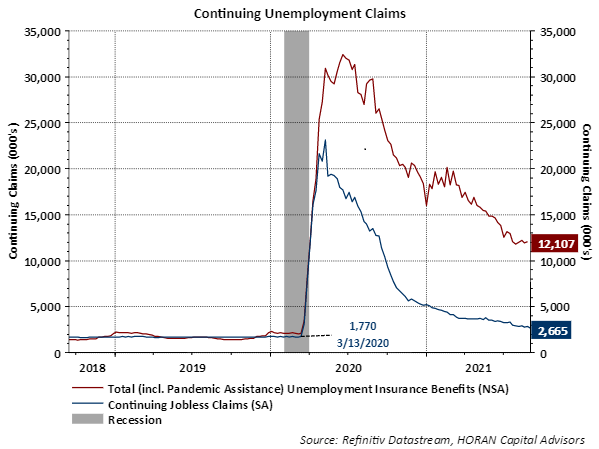

It is suspected one reason open positions remain high at the same time joblessness remains high is due to the extra pandemic assistance unemployment (PAU) benefit. This benefit ended on September 5. The below chart shows data for continuing claims and the PAU insurance category as of a date just before the expiration of the PAU benefit. The PAU category is reported with weekly continuing jobless claims data but the PAU category is reported with a few week lag. It will be important to see this PAU category begin to decline further.

On top of the hiring difficulties facing companies, consumer demand (pent up demand) is high for products and services following the COVID-19 pandemic shutdown. Many individuals have read or heard about the clogged supply chains. Accenture recently released a report, Supply Chain Disruption, that notes:

- 94% of Fortune 1000 companies are seeing supply chain disruptions from COVID-19.

- 75% of companies have had negative of strongly negative impacts on their businesses.

- 55% of companies plan to downgrade their growth outlooks (or have already done so).

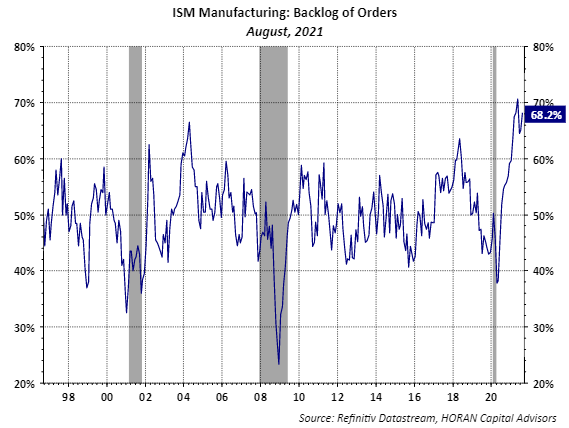

So supply chain issues and underemployment have led to record backlog. The August manufacturing report by The Institute for Supply Management (ISM) notes the growing level of backlog remains at a high level of 68.2%, indicating order backlogs expanded for the 14th straight month. A sample response from one survey participant notes, "Customer order backlog continues to climb because we are unable to raise production rates due to supplier parts and manpower challenges. Continue to see price increases with key commodities, and logistics is an ongoing challenge that has no end in sight."

The supply chain constraints are partially driven by reduced employment, some related to COVID shutdowns or restrictions, as well as the inability of companies to fill open positions. The recent end to some of the government financial support programs may or should lead to faster job hiring. One consequence of reduced employment and constrained supply chains is demand is exceeding supply and pushing prices higher. This leads to higher inflation, which is occurring now, even if transitory. All of this can be a headwind to economic growth going forward. At the end of the day, supply chain constraints and the inability of companies to produce product can be damaging to future economic growth. It is crucial this inability to hire by companies is resolved and this may be one of the more important economic issues at this point in time.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.