Author: David I Templeton, CFA, Principal and Portfolio Manager

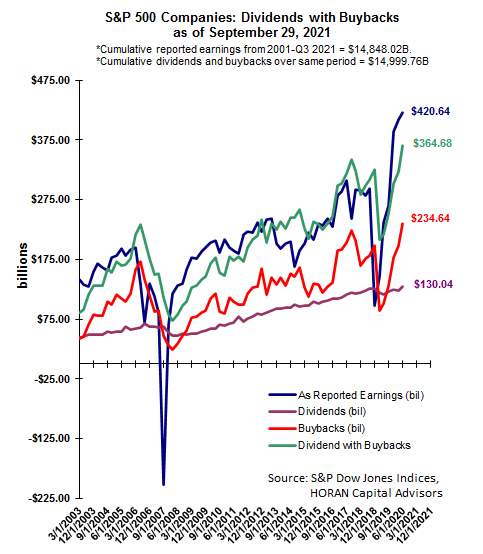

S&P Dow Jones Indices recently reported preliminary buyback and dividend data for for the S&P 500 Index through the third quarter and records were achieved for both. Buybacks equaled $234.6 billion in the quarter, up 18% versus Q2 2021 and dividends equaled $130.4 billion, up 5.4% versus Q2 2021. On a combined basis, dividends plus buybacks equaled $364.68 billion in Q3 2021, up 13.2% month over month and up 67.8% on a year over year basis.

As noted in the S&P Dow Jones Indices' report:

- For the 12-month September 2021 period, buybacks were $742.2 billion, a 21.8% increase from $609.4 billion in the 12-month June 2021 period, and up 30.0% from $570.8 billion in the 12-month September 2020 period.

- Total shareholder return for the 12-month September 2021 period increased to $1.24 trillion from June 2021's $1.09 trillion and September 2020's $1.06 trillion.

According to Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, "While companies bought back shares in record numbers in Q3 2021, their expenditures appear cautious when measured against their earnings and market value. Additionally, the impact on share count remains significantly lower compared to previous years as higher stock prices have reduced the number of shares companies can buy back with their current expenditures. For the quarter, 248 companies reduced their share counts from Q2 2021, up from 238 in the prior quarter (90 in Q3 2020), but still far from the 322 in pre-COVID Q1 2020, as the year-over-year significant EPS boost from fewer shares remains low at 37 for Q3 2021 compared to 115 for the Q3 2019 period."

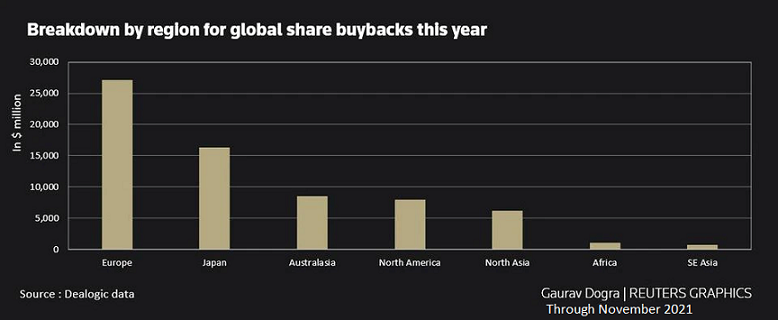

The increased stock buyback activity is not unique to the U.S./North America market. In a recent Reuters article it is noted that companies in North America place fourth in buyback activity out of seven other regions around the globe though November.

The increase in dividends and buyback activity is commensurate with improved earnings growth as the severity of the pandemic seems to be waning, which has translated into favorable stocks returns, especially for the U.S. market.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.