Author: David Templeton, CFA, Principal and Portfolio Manager

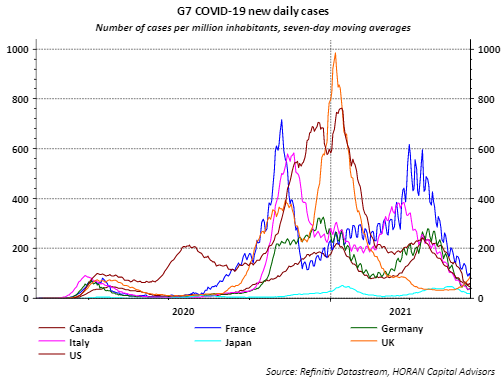

More states and countries are experiencing much reduced Covid-19 cases and are reopening their economies. The below chart shows the number of new Covid cases per million persons has fallen significantly. The increasing number of those vaccinated along with those individuals that contracted Covid is likely leading to herd immunity while of course keeping an eye out for the potential impact of variants.

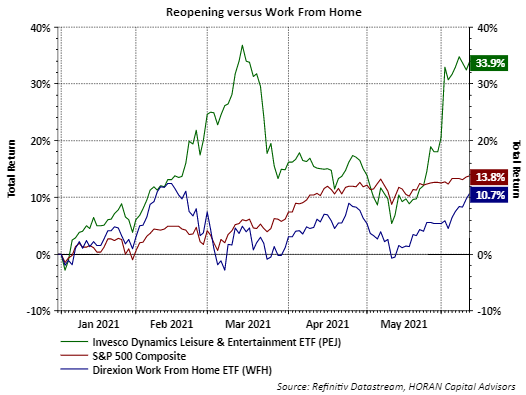

As this reopening pace quickens, individuals/consumers seem to be scrambling to satisfy some pent-up demand. As a result the 'work from home' oriented stocks are taking a back seat to the travel, leisure and entertainment stocks. The investments that benefited the most from the 'work from home' theme had some relationship to technology, for example, Zoom Video Communications (ZM). As more people go back to work in the office environment, the WFH stocks are lagging those that benefit from opening economies. These WFH stocks are lagging in performance relative to the broader market and the leisure and entertainment oriented companies (PEJ).

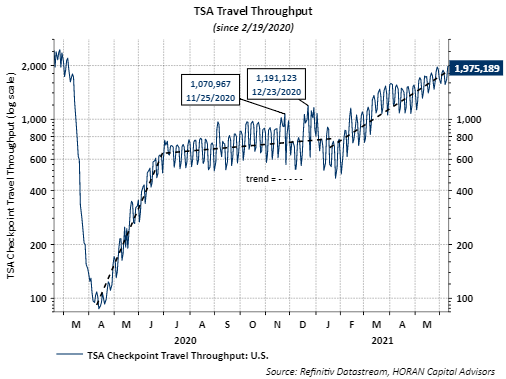

Another perspective on travel and leisure is reviewing the TSA Travel Throughput data. After the initial pandemic contraction in early 2020 TSA Throughput rebounded to about 600,000 travelers per day but seemed to move sideways for most of the second half of 2020. Beginning in 2021 though, traveler throughput has steadily recovered with the latest traveler count equalling nearly 2.0 million. The pre-pandemic level was 2.5 million travelers per day and the current trend would reach the pre-pandemic level in mid to late summer.

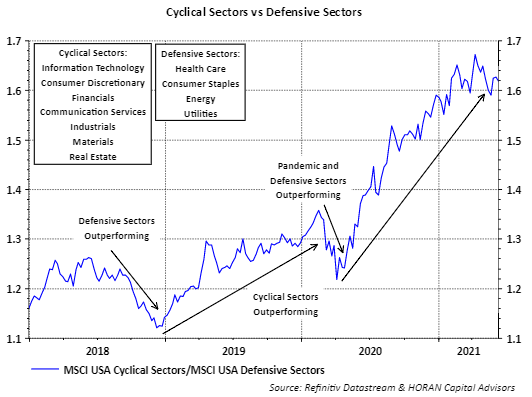

And lastly, the rotation away from the 'work from home' and defensive investments is benefiting the more cyclical or economically sensitive stock sectors. The below chart compares the MSCI USA Cyclical Sectors Index (PDF) to the MSCI USA Defensive Sectors Index (PDF). The rotation into the more cyclical sectors began near the pandemic market low in late March and early April and was one reason our firm's view anticipated a sharp recovery from the selloff. The cyclical sector outperformance has continued this year. Included in MSCI's cyclical sectors index is the technology and consumer discretionary sectors, two sectors that were top performing ones during the pandemic, but are the weaker performing cyclical sectors this year. The energy, financial and real estate sectors returns have ranged from 25% to 48%, far outpacing the single digit return in both the discretionary and technology sectors.

Both the Dow Jones Index and the S&P 500 Index are up mid to low teens so far in 2021. In most years one would be satisfied with this return for a full twelve month period. I note this because the market is unlikely to trend higher in a straight line and a pullback in equity prices would not be a surprise and is normal for the market in a given year. Given the strength of the economy and the consumer, and likely more individuals coming into the workforce, all else being equal, a pullback probably does not derail this bull market.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.