Author: David Templeton, CFA, Principal and Portfolio Manager

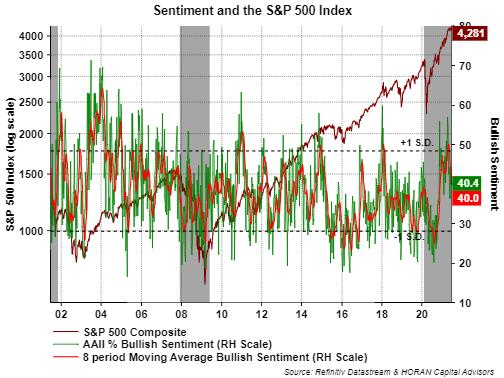

On a price only basis the S&P 500 Index is up over 91% since the March 23, 2020 low. Nearly halfway through 2021 and the S&P 500 Index is up a strong 14%. One can look at these returns and match them up to the S&P 500 Index's valuation and valuations are elevated. In a low interest rate environment though, it is reasonable for stocks to trade at a higher valuation. Additionally, when evaluating investor sentiment and equity fund flows, it does not appear investors are all in on stocks.

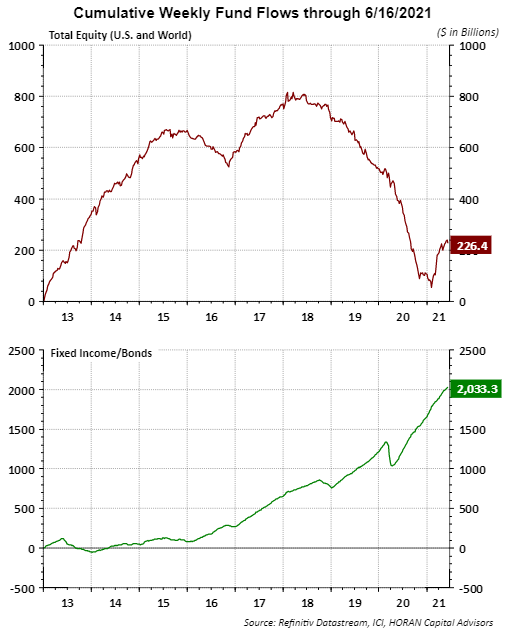

The below chart shows cumulative weekly flows into stocks and bonds. The area that has attracted the most investor interest is bonds, up over $2 trillion since 2013. Cumulative equity flows of $226 billion lags far behind the flows into bond ETFs and mutual funds. The downward trending maroon line since 2018 means investor flows are coming out of stocks.

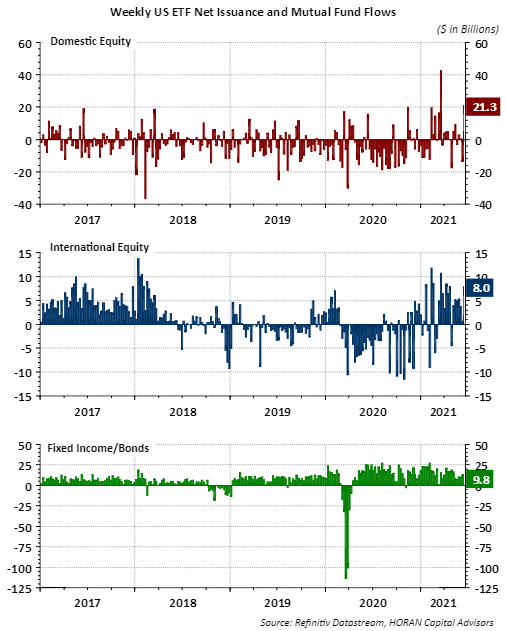

The increase in equity flows in 2017 was supported by strong and consistent flows into international equities. The third panel in the below chart clearly shows that the bond category received the most stable investor inflows since 2017.

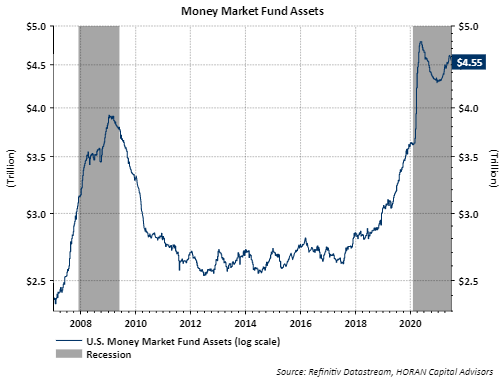

And one last observation on fund flows is displayed in the below chart. Nearly $4.6 trillion resides in money market funds, a staggering amount given the low or no rate of return on those funds in this low interest rate environment. Money market assets did decline from June of last year to the end of 2020, but the above chart shows much of the money market outflows went into bond ETFs and bond mutual funds.

So fund flows certainly represent one view on investor sentiment as it looks at actual investor actions versus a response to a survey. Yet, the surveys also suggest investors are not overly bullish. Last week's report from the American Association of Individual Investors' Sentiment Survey showed bullish sentiment declined slightly to 40.4%, which is down from early April's 56.9% level. These sentiment results are most actionable at their extremes and this 40% level is far from an exteme falling in between the extreme bullishness and extreme bearishness levels.

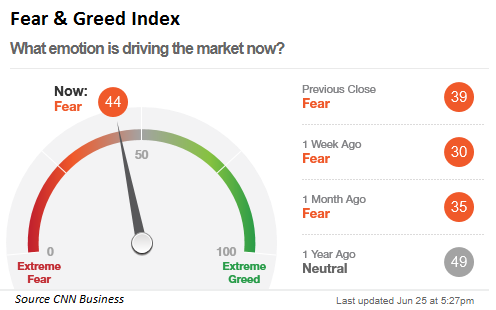

The other sentiment reading worth reviewing is the CNN Business Fear & Greed Index. This index incorporates seven different sentiment measures, such as the VIX reading, market momentum and the CBOE Put/Call Ratio. The current reading falls just in the fear range at 44. This is not extreme fear, but the index is not at an extreme greed level either.

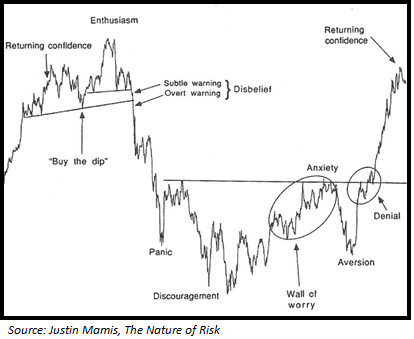

In conclusion, stock valuations are elevated; however, analyst have under estimated earnings growth for companies as the economy exits the pandemic induced recession. Most S&P 500 companies have reported first quarter earnings and an astounding 87% reported earnings above analyst estimates versus the long term average of 65%. So if earnings growth continues to be reported better than expectations, valuations are likely not as elevated as they might appear. Additionally, both investors' actions and sentiment responses do not seem to be indicating excessive exuberance. This seems a perfect "climb a wall of worry" market.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.