Author: David I. Templeton, CFA, Principal and Portfolio Manager

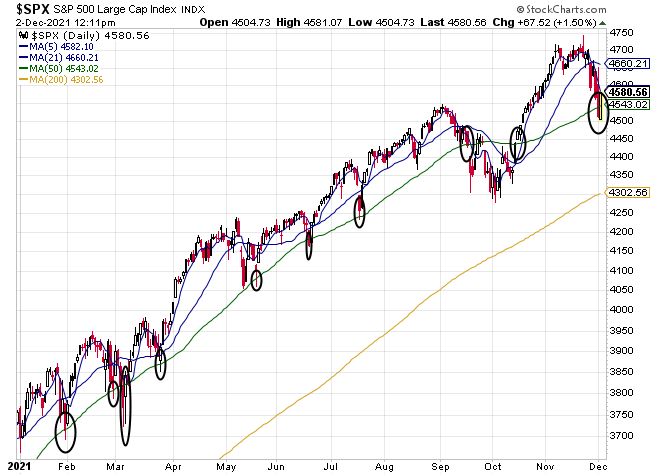

Just as investors become fearful of stocks, the equity market experiences a turnaround. Before today's (12/2/2021) trading the S&P 500 Index was down a little more than 4% from its November 18, 2021 high. Yesterday, the S&P 500 Index closed below its 50-day moving average, an area where the market has recently found support as seen in the below chart.

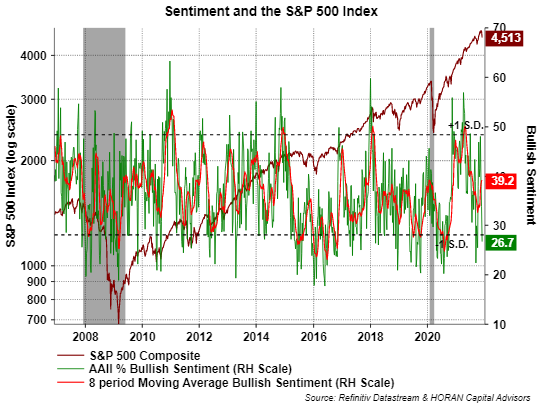

From an investor sentiment perspective, today's Sentiment Survey report by the American Association of Individual Investors saw bearish sentiment increase to its highest level in more than a year at 42.4%. The other side of the bearish coin is bullishness and it fell to a low 26.7%.

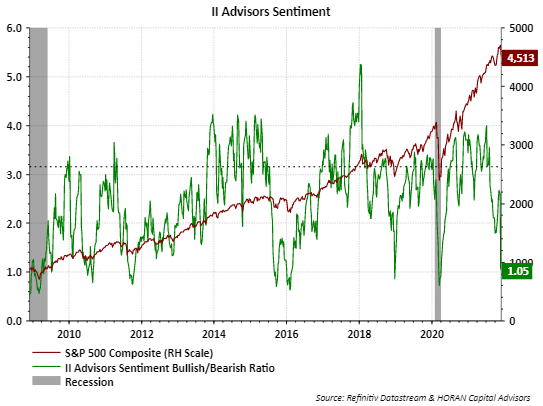

Bearishness is also being expressed by newsletter writers. The ratio of the bullish to bearish advisor sentiment has declined to 1.05. A ratio less than 1.0 indicates there were more newsletter authors with a bearish stance than a bullish one. The Investor Intelligence Advisors' Sentiment Survey studies over a hundred independent market newsletters and assesses each author’s current stance on the market: bullish, bearish or correction.

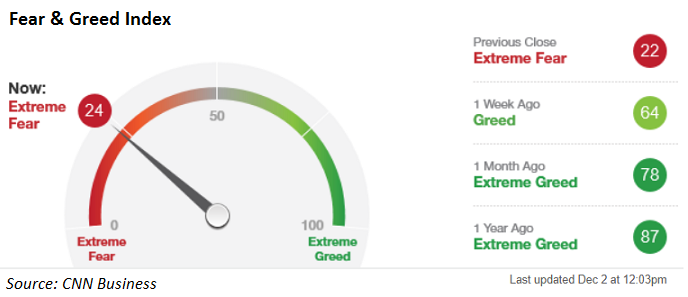

Finally, the CNN Business Fear & Greed Index now resides in the extreme fear zone too. The Fear & Greed Index is meaningful in that it incorporates seven various sentiment measures into an overall reading.

Sentiment measures are contrarian ones and with the widespread bearishness being expressed by many investors, today's market bounce is not too surprising. Bearishness is not at a rock bottom extreme so more choppiness might be expected. Nonetheless, with business fundamentals remaining favorable, and economic ones as well, equity prices might be setting a path for a year end rally.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.