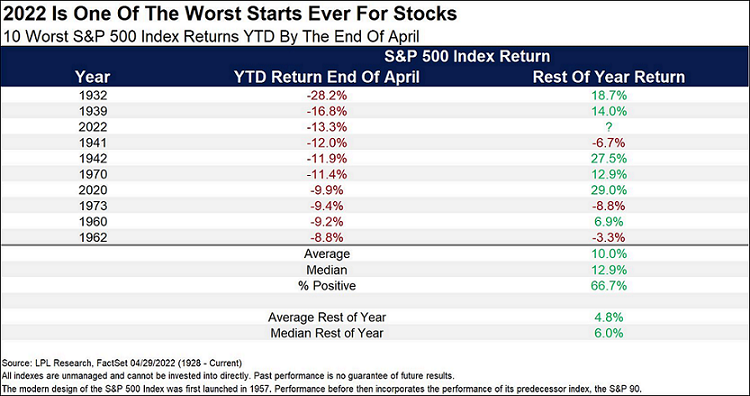

With the just completed month of April, the first four months of 2022 have not been rewarding ones for investors. The total return for the S&P 500 Index through the first four months of the year has the index down -12.92%. Ryan Detrick of LPL Research looked at the price return for the index and this decline is the third worst start to a year going back to 1928 as seen in the below table. Encouragingly, returns following a weak start to a year tend to be mostly positive.

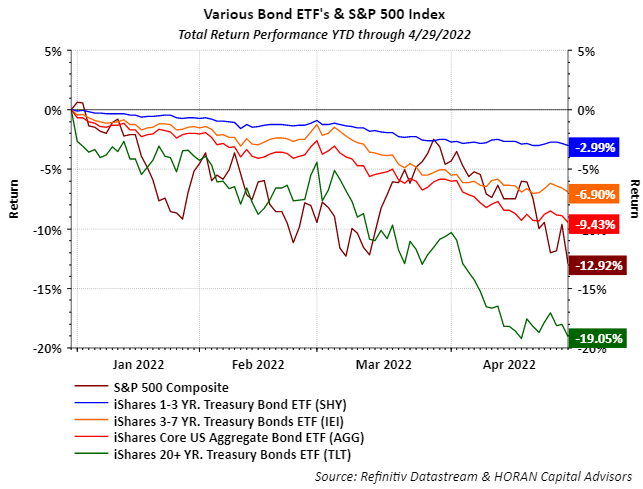

What makes the current environment more difficult for investors is the fact bond returns have been almost as weak as equity returns. The Bloomberg Aggregate Total Return Bond Index is down nearly 10% through the first four months of this year and this is the worst performance for this index to start a year going back to the indexes inception date in 1973. Longer maturity bonds have performed even worse with the iShares 20+ Year Treasury ETF (TLT) down -19.05% just this year.

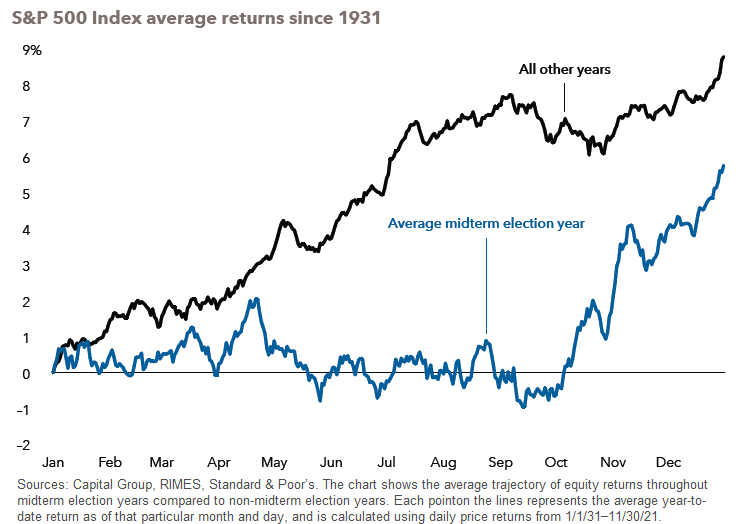

April is generally one of the stronger months of the year, but this year’s April return goes against history. The second and third quarters of the second year in the presidential cycle tend to be the weaker ones, so investors might be in for a little more market volatility over the next quarter and a half. After the election though, some of the market’s strongest returns have been in the 12-month period following mid-term elections as we noted in an earlier Investor Letter.

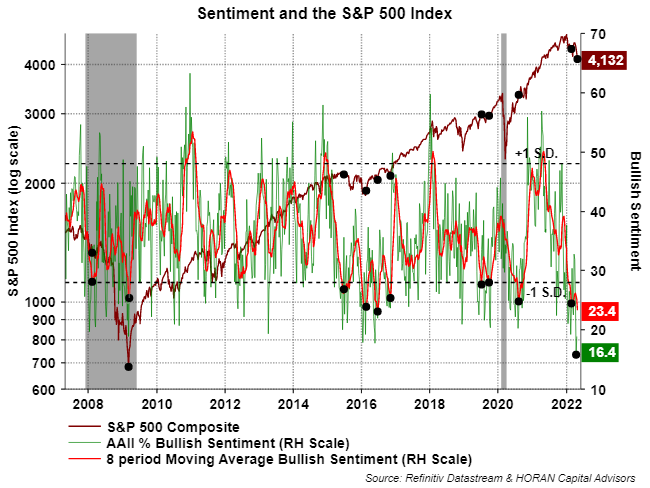

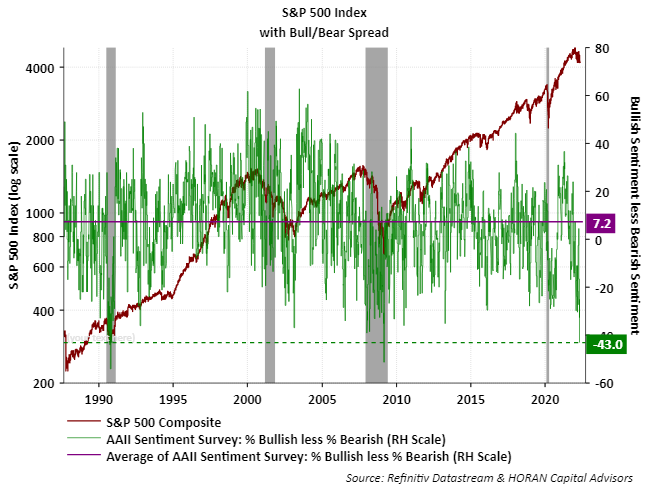

The other variable that might provide an indication of a market bounce is the weakness being seen in some of the investor sentiment indicators. Last week’s American Association of Individual Investors (AAII) Sentiment Survey report showed individual bullish sentiment remains at a near record low. Additionally, as seen in the second chart below, the bull/bear spread is at a level only seen a few other times in the Survey’s history, indicative of a high level of investor bearishness. With sentiment measures being contrarian ones, a market bounce might be forth coming.

Lastly, S&P 500 company earnings have been favorable for the first quarter. Year over year (YoY) earnings growth is 10.1% for the 275 companies that have reported, ex-energy though the YoY increase is 4.4% and 80.4% of companies reporting have exceeded analyst earnings estimates. Revenues have been good as well, up 12.5% and ex-energy up 9.3%. Certainly inflation is a tailwind for revenue growth, but this does make stocks a reasonable inflation hedge. Investors should expect more volatility, but investor bearishness is at a high level and this is one near term positive for stocks.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.