Author: David I. Templeton, CFA, Principal and Portfolio Manager

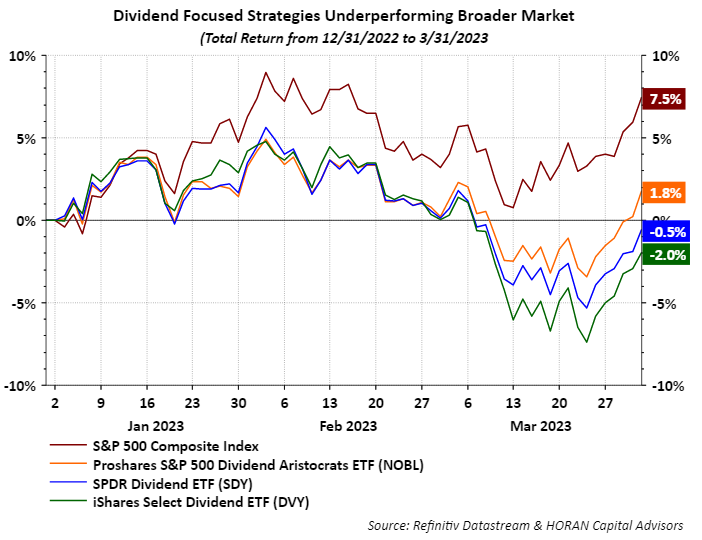

Investments firms often issue the caveat that "past performance is no guarantee of future results." One area where this is proving to be true this year is with respect to the performance of dividend focused stocks. In 2022 it was the dividend focused stocks that were a bright spot relative to the performance of most other asset classes. In my post at the end of December I noted several dividend paying strategies far outpaced the broader S&P 500 Index in 2022. As the first quarter came to a close on Friday, it is the income focused equity strategies that are lagging the broader market as seen below.

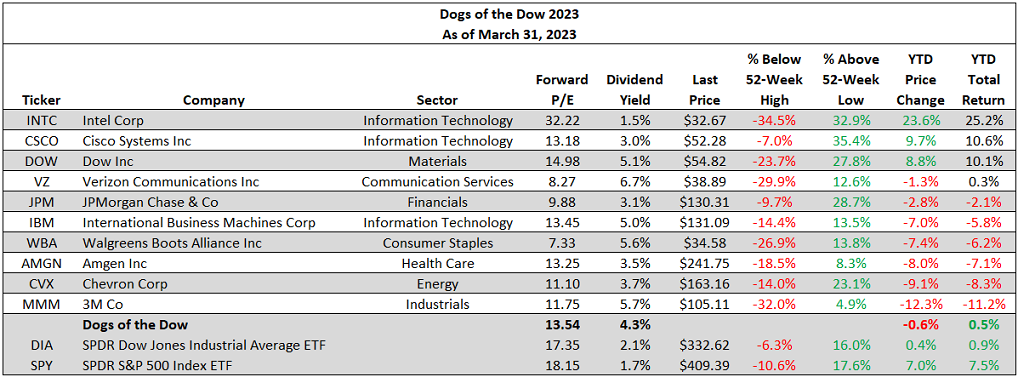

The Dogs of the Dow strategy has the sole focus of investing in the highest dividend yielding stocks in the Dow Jones Industrial Average Index. As I have noted in prior Dow Dog articles, the Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year.

The below table shows the performance of the strategy for the first quarter of 2023. The Dow Dogs return of .5% slightly lags the complete Dow Jones Industrial Average Index return of .9% but the Dow Dogs return is far behind the S&P 500 Index return of 7.5%. The table includes Intel (INTC) as the company's dividend yield at the end of 2022 was over 5%, but in February Intel cut its dividend by 66%. Even though Intel now has one of the lowest yields of the dividend payers in the Dow Index, it will remain in the portfolio for the entire year. Clearly, as seen in the table, the dividend cut has not hindered the stock's performance.

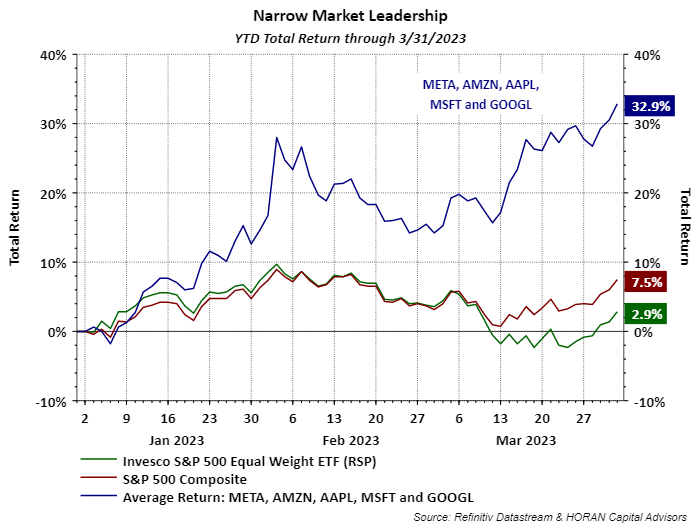

One aspect of first quarter returns is the fact a handful of stocks contributed to the market's overall positive performance. This narrow market leadership is evident in the below chart where just five technology stocks generated an average return of 32.9% versus the S&P 500 Index return of 7.5% and the S&P 500 equal Weighted ETF return of just 2.9%.

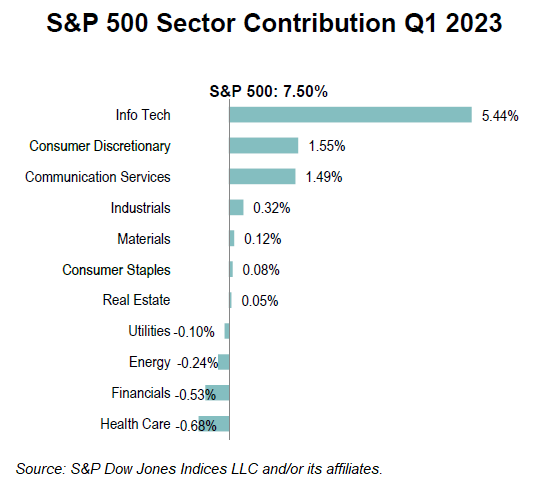

And lastly, with the strength of technology stocks, this concentration of return was obviously evident at the sector level as well. Out of the quarters 7.5% return for the S&P 500 Index, 5.4 percentage points were contributed by the technology sector as seen in the below graph.

The market's apparent renewed focus on growth stocks and a more risk on appetite seems driven by an expectation that inflation is being contained and the Fed is near a pause in its rate increase cycle. We plan to have more thoughts on this in our first quarter Investor Letter to be completed in the next week or so.

Disclosure: Firm/Family long AMGN, DOW, VZ, INTC, MMM, JPM, CSCO

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.