Author: David I. Templeton, CFA, Principal and Portfolio Manager

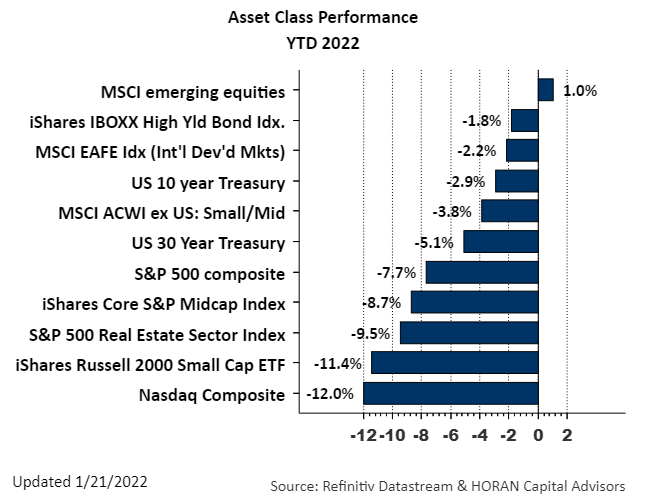

As the new year gets underway the equity market so far in January has not been kind to investors. Both stock and bond investments are mostly down with the Nasdaq Composite Index down 12.0%, the Russell 2000 Small Cap Index down 11.4% and the 30-Year U.S. Treasury down 5.1%, just to name a few. One positive performer is the MSCI Emerging Markets Index which is actually up 1.0%.

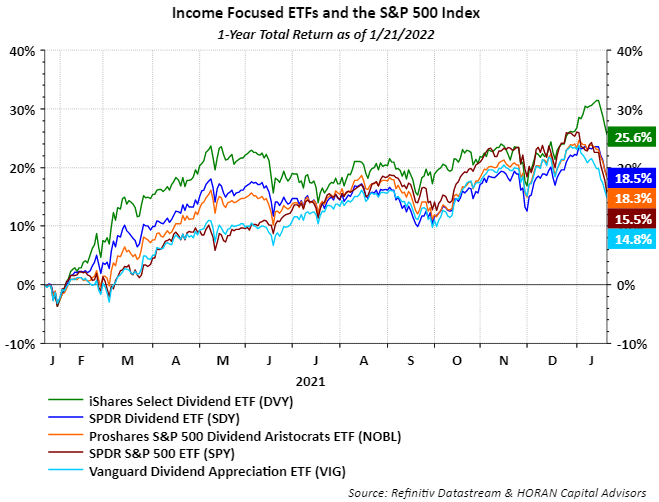

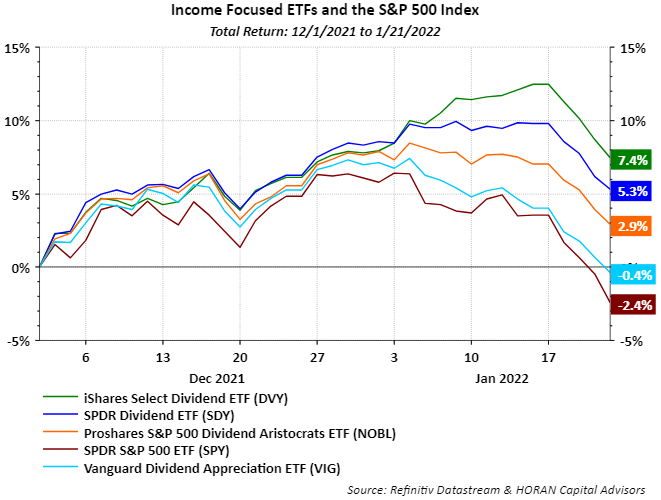

With this broad based market weakness, one stock characteristic that has served investors well of late is the support provided by dividends for dividend paying stocks. I have touched on the attractiveness of dividend paying stocks over the last year or so in several articles, Maybe Time To Include Dividend Growth Equities To One's Portfolio and Dividend Paying Strategies Have Lagged This Year, Now An Opportunity?. The two charts below show the the dividend focused indexes have outperformed the broader S&P 500 Index over the last year, 25.6% for the iShares Select Dividend ETF (DVY) versus the S&P 500 Index return of 15.5%, and the shorter time period beginning December 1, 2021, DVY up 7.4% and the S&P 500 Index down 2.4%.

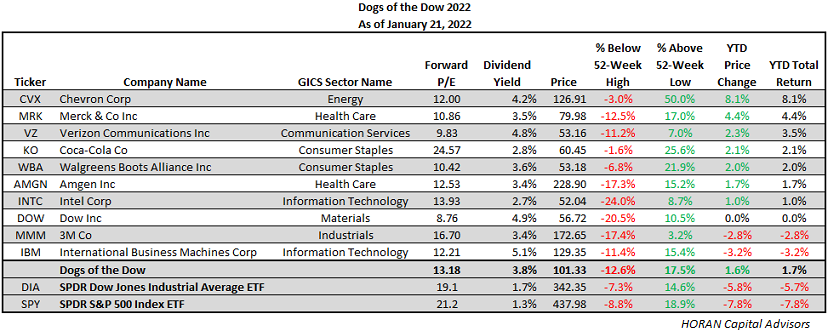

The other strategy that has a dividend focus is the Dogs of the Dow. In an article at the beginning of the year, I reviewed the Dow Dogs performance for 2021 and included the stocks that are a part of the 2022 Dow Dogs. This strategy's singular focus is selecting the highest dividend yielding stocks in the Dow Jones Industrial average at the end of the prior year and investing an equal dollar amount in each stock. The Dow Dogs have also generated a positive return as the year gets underway. The Dow Dogs are up 1.7% year to date versus the Dow Jones Index down 5.7% and the S&P 500 Index down 7.8%.

As of mid-year last year, the dividend focused Dividend Aristocrats strategy has underperformed the S&P 500 Index on a 10-year annualized return basis. In what seems to be an environment for higher market volatility, at least near term, maybe the high quality dividend paying stocks provide some shelter in the storm for investors. The market is dealing with uncertainty as it relates to the Fed and its interest rate policy as well as this being a mid-term election year in the U.S. One thing the market struggles with is uncertainty and stocks that pay dividends might weather the uncertainty a little better in the first half of the year.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.