Author: David I. Templeton, CFA, Principal and Portfolio Manager

The Weekly Petroleum Status Report released by the EIA on Wednesday showed crude inventory, excluding the Strategic Petroleum Reserve (SPR), fell 4.8 million barrels from the prior week. The oil inventory level is 11% below the five year average for this time of year. The report also notes inventory for other oil product types are also down,

"Total motor gasoline inventories decreased by 1.6 million barrels last week and are about 3% below the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week. Distillate fuel inventories decreased by 0.9 million barrels last week and are about 19% below the five year average for this time of year. Propane/propylene inventories decreased by 1.9 million barrels last week and are about 11% below the five year average for this time of year. Total commercial petroleum inventories decreased by 8.1 million barrels last week."

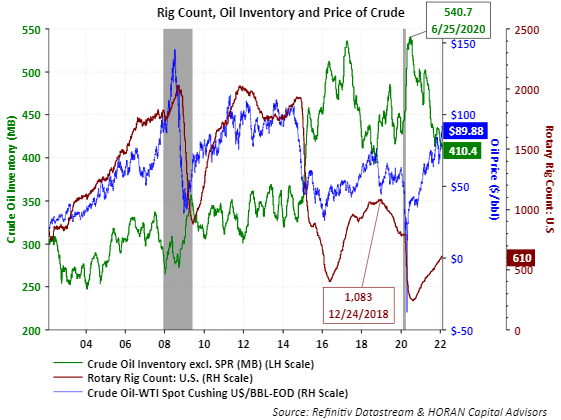

As the green line in the below chart shows, oil inventory is down nearly 25% from its June 25, 2020 level. Additionally, rotary rig count (maroon line) in the U.S. of 610 rigs remains below the December 24, 2018 level of 1,083, or down nearly 45%.

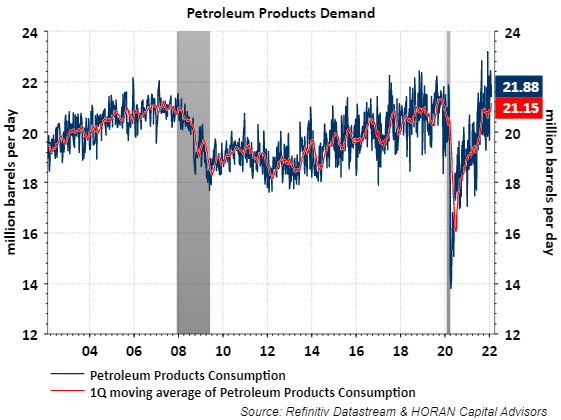

Higher oil prices place upward pressure on inflation. Energy's weighting in the Consumer Price Index is 7.34% and the energy category is up 27% for the twelve months ending in January. Gasoline itself is up 40% for the same twelve month period. With oil demand continuing to rise and near a level reached in late 2018, without more drilling or increased supply, oil prices are likely to continue their move higher, all else being equal.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.